A mid-year report devoted to the average home prices in Turkey has been published, based on the performance in the first half of 2022 (January through June) and over the past 12 months, which are quite indicative. It was approximately by the beginning of last July that life in Turkey almost normalized after the previous pandemic year. This was the time developers found new momentum, as traveling around the country became far easier, particularly when visiting it from abroad. By then, buyers could select and purchase a home at leisure and after adequate consideration.

Home prices continue to grow and show no signs of slowing down.

Content:

- Sale

- Information on the TOP 30 provinces by sales

- Summary of housing sales

- Rent

- Information on the TOP 30 provinces by rent

- Summary

Sale

According to Endeksa (an analytical web portal), the annual increase in home prices in Turkey was 182% as of June.

In June, Endeksa published detailed statistics on 30 of the most expensive provinces based on the average value per square meter of residential property.

Istanbul, Antalya, and Mersin were the top three by growth value. Remarkably, Mersin repeatedly makes it to the top of different ratings. This province is rapidly developing its economy and becoming more important as the Akkuyu Nuclear Power Plant is being built there and a great number of competent professionals, blue-collar workers, and others flock there. The value of housing increases accordingly.

The performance of the TOP 3 provinces is as follows:

- Home prices in Istanbul grew by a staggering 234% over the past year. The average selling price of a square meter of housing was 17,592 Turkish Liras (TL), while the average value of a residential property reached TL 2,109,480.

- The annual growth value in Antalya was 226%, the average selling price of a square meter of housing was TL 14,961, and the average value of a residential property was TL 1,944,930.

- The annual growth value in Mersin was 223% (notably, it was almost equal to the growth in Antalya). The average selling price of a square meter of housing was TL 8,914, and the average value of a residential property was TL 1,335,150.

Information on the TOP 30 provinces by sales

| Province | Average selling price in June 2022 (TL/1 sq m) | Average cost of residential property for sale in June 2022 (TL) | Average selling price over past 12 months (TL/1 sq m) | Average cost of residential property for sale over past 12 months (TL) | Investment payback period (years) | Change (growth) of value (%) |

|---|---|---|---|---|---|---|

| Muğla | 24,969 | 3,469,023 | 15,517 | 2,048,244 | 18 | 178 |

| Istanbul | 17,592 | 2,109,480 | 10,000 | 1,150,000 | 17 | 234 |

| Antalya | 14,961 | 1,944,930 | 8,500 | 1,045,500 | 16 | 226 |

| Aydin | 14,232 | 2,063,630 | 9,000 | 1,305,000 | 38 | 170 |

| Izmir | 12,742 | 1,656,460 | 7,785 | 973,125 | 20 | 172 |

| Balikesir | 11,591 | 1,483,648 | 6,900 | 848,700 | 30 | 184 |

| Çanakkale | 11,467 | 1,134,840 | 6,500 | 747,500 | 23 | 193 |

| Yalova | 9,219 | 1,197,430 | 5,500 | 687,500 | 21 | 186 |

| Bursa | 8,986 | 1,231,082 | 5,235 | 680,550 | 23 | 179 |

| Mersin | 8,914 | 1,335,150 | 4,625 | 693,750 | 20 | 223 |

| Kocaeli | 8,716 | 1,177,200 | 4,862 | 632,060 | 21 | 203 |

| Bartin | 8,615 | 896,584 | 5,187 | 544,635 | 27 | 152 |

| Adana | 8,581 | 1,372,960 | 5,118 | 818,880 | 26 | 199 |

| Gaziantep | 8,306 | 1,327,520 | 5,517 | 885,135 | 23 | 149 |

| Samsun | 8,223 | 1,151,080 | 4,710 | 635,850 | 22 | 178 |

| Edirne | 8,177 | 938,170 | 4,800 | 528,000 | 20 | 151 |

| Sakarya | 8,119 | 974,280 | 5,100 | 596,700 | 22 | 178 |

| Isparta | 8,087 | 1,051,830 | 5,000 | 650,000 | 23 | 138 |

| Denizli | 7,981 | 1,077,705 | 5,000 | 700,000 | 24 | 140 |

| Sinop | 7,733 | 927,360 | 5,132 | 615,840 | 28 | 139 |

| Tekirdağ | 7,570 | 1,058,540 | 4,431 | 598,185 | 18 | 201 |

| Trabzon | 7,519 | 1,210,237 | 4,310 | 689,600 | 32 | 170 |

| Ankara | 7,389 | 982,604 | 4,500 | 585,000 | 17 | 171 |

| Eskişehir | 7,308 | 913,500 | 4,923 | 590,760 | 23 | 138 |

| Rize | 7,292 | 1,025,640 | 4,429 | 611,202 | 28 | 144 |

| Zonguldak | 7,148 | 928,590 | 4,333 | 563,290 | 24 | 137 |

| Manisa | 7,145 | 914,560 | 4,786 | 598,250 | 24 | 133 |

| Ordu | 7,143 | 964,035 | 44,223 | 592,682 | 28 | 153 |

| Tunceli | 7,104 | 921,830 | 5,119 | 691,065 | 24 | 85 |

| Burdur | 7,104 | 923,390 | 4,286 | 533,322 | 25 | 148 |

Summary of housing sales:

- In June 2022, the highest prices were in Muğla (TL 24,969), Istanbul (TL 17,592), Antalya (TL 14,961), Aydin (TL 14,232), and Izmir (TL 12,742).

- The cheapest provinces were Burdur, Tunceli, Ordu, Manisa, and Zonguldak, where the prices were within TL 7,200.

- Homes for under one million Turkish Liras are available in 11 provinces – Burdur, Tunceli, Ordu, Manisa, Zonguldak, Eskişehir, Ankara, Sinop, Sakarya, Edirne, and Bartin.

- Provinces where average homes are worth more than 2 million Turkish Liras are Istanbul, Aydin, and Muğla. In the latter, housing is one and a half times more expensive than even in Istanbul and Aydin (TL 2.1 million and TL 2 million respectively).

- Antalya is only slightly behind the top three with the average value of a residential property at almost two million (TL 1,944,930).

- Tunceli had the lowest annual growth value of only 85%.

- The longest housing payback period (38 years) is in Aydin. In all other provinces, it is within 30 years and in many cases, much sooner.

Rent

Rental rates are increasing rapidly along with selling prices. According to Endeksa analysts, the rent in Turkey grew by 156% over the past year and by 234% over the past four years, based on averaged and official performance indicators. This means that rental rates can differ drastically in certain provinces, cities, districts, and even neighborhoods.

The average rent per square meter in Turkey was TL 48.74, while the average rental payment in June was TL 5,361. The average payback period of investment in buy-to-rent residential property was 17 years.

Information on the TOP 30 provinces by rent

| Province | Average cost of housing rent in June 2022 (TL/1 sq m) | Average cost of rent per residential property in June 2022 (TL) | Average cost of housing rent over past 12 months (TL/1 sq m) | Average cost of rent per residential property over past 12 months (TL) | Investment payback period (years) | Change (growth) of rental rates over 12 months (%) |

|---|---|---|---|---|---|---|

| Muğla | 136 | 14,937 | 72 | 7,900 | 18 | 73 |

| Antalya | 95 | 10,397 | 46 | 5,021 | 17 | 310 |

| Istanbul | 79 | 8,107 | 49 | 5,079 | 17 | 168 |

| Izmir | 61 | 6,968 | 32 | 3,552 | 20 | 172 |

| Çanakkale | 37 | 3,487 | 23 | 2,101 | 23 | 140 |

| Ankara | 37 | 4,393 | 22 | 2,622 | 17 | 164 |

| Sakarya | 34 | 3,260 | 19 | 2,057 | 22 | 151 |

| Kocaeli | 33 | 3,801 | 19 | 2,192 | 21 | 178 |

| Gaziantep | 33 | 3,282 | 20 | 2,600 | 23 | 91 |

| Tekirdağ | 32 | 3,563 | 20 | 2,200 | 18 | 147 |

| Samsun | 31 | 3,038 | 18 | 1,966 | 22 | 153 |

| Nevşehir | 30 | 2,332 | 19 | 1,601 | 19 | 86 |

| Eskişehir | 30 | 2,707 | 18 | 1,617 | 23 | 131 |

| Aydin | 30 | 3,285 | 20 | 2,200 | 38 | 88 |

| Yalova | 30 | 3,277 | 22 | 2,400 | 21 | 112 |

| Edirne | 30 | 2,446 | 20 | 1,800 | 20 | 89 |

| Isparta | 29 | 1,726 | 18 | 1,170 | 23 | 140 |

| Denizli | 28 | 2,660 | 17 | 1,637 | 24 | 100 |

| Bartın | 28 | 2,217 | 16 | 1,500 | 27 | 141 |

| Bursa | 28 | 3,172 | 19 | 2,095 | 23 | 99 |

| Mersin | 27 | 3,205 | 19 | 2,596 | 20 | 83 |

| Tunceli | 26 | 3,096 | 18 | 2,187 | 24 | 48 |

| Adana | 25 | 2,963 | 17 | 2,117 | 26 | 110 |

| Konya | 25 | 3,274 | 14 | 1,972 | 24 | 171 |

| Manisa | 25 | 2,720 | 17 | 1,833 | 24 | 120 |

| Zonguldak | 25 | 2,082 | 15 | 1,500 | 24 | 105 |

| Balıkesir | 25 | 2,456 | 19 | 1,912 | 30 | 67 |

| Düzce | 24 | 2,046 | 15 | 1,384 | 22 | 128 |

| Kirklareli | 24 | 2,379 | 15 | 1,610 | 23 | 124 |

| Bolu | 24 | 2,395 | 14 | 1,500 | 25 | 143 |

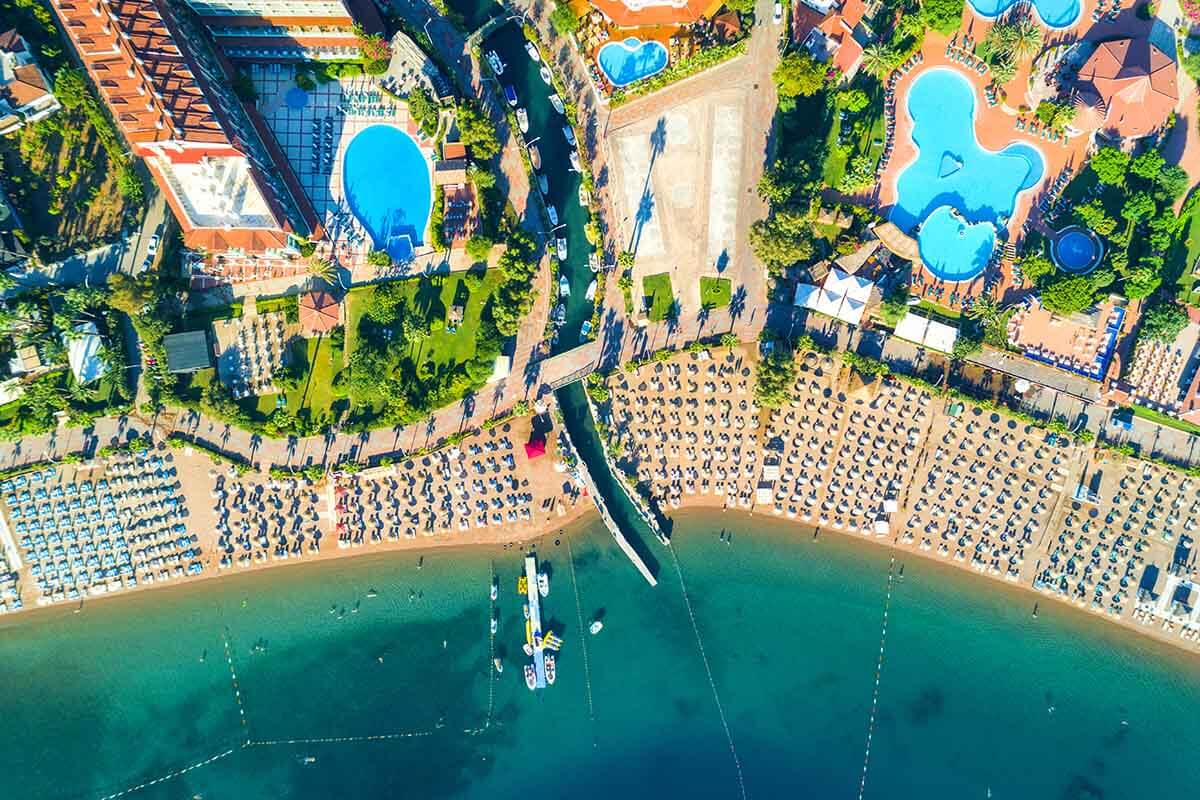

As the table shows, the provinces with the highest rental rates were Muğla (with resorts such as Fethiye, Marmaris, Bodrum, Ölüdeniz, and others), Antalya (with the resorts of Antalya, Alanya, Kemer, Side, Belek, Kaş, Kalkan, and others), and Istanbul.

Over the same period, the annual rent growth in Muğla, the most expensive province, was not as impressive with 73%, and an average rent of TL 136 per square meter and TL 14,937 for a residential property, with a payback period of 18 years.

The rent in Antalya made a huge leap of 310% over the past year. The average rent per square meter is TL 95, and the rent for residential property is TL 10,397. The payback period reached 16 years.

In Istanbul, renting a square meter cost TL 79 in June, and an average apartment, TL 8,107. The rent grew by 168%, while the payback period dropped drastically – down to only 17 years (it used to be far longer).

Summary:

- The greatest annual price growth occurred in Antalya (+310%), Kocaeli (+178%), Izmir (+172%), Konya (+171%), and Istanbul (+168%).

- Tunceli (48%), Balıkesir (67%), and Muğla (73%) were the provinces with the smallest price growth.

- The longest payback periods are in Aydin (38 years) and Balikesir (30 years).

- Return on investment can be expected the soonest in Antalya (16 years). It is also reduced to 17 – 24 years in several provinces where it used to be much longer.

- The highest rental rate per square meter, as of the end of June, was in Muğla (TL 136), Antalya (TL 95), Istanbul (TL 79), and Izmir (TL 61). The fifth place in the top five is shared by Çanakkale and Ankara (TL 37 in each case). The average rent per square meter in all other provinces is under TL 35.

- As for the rent for a residential property, Antalya (with TL 10,397) and Muğla (with TL 14,937) are the most expensive provinces. Renting a home is also quite expensive in Istanbul and Izmir (TL 8,107 and TL 6,968 respectively). In all other provinces, it costs four thousand liras or less.

Görkem Öğüt, the partner, founder, and General Manager of Endeksa evaluated this statistical data and made the following conclusion: “Summer months are a time of significant residential activity in seafront provinces. At the same time, home prices continue to grow significantly. On the other hand, even though the value of residential property increases every month, we observe a slight downtrend in the growth rates, e.g. the monthly growth of 14.7% in May reduced to 11.4% in June. The decision to impose restrictions on granting home loans based on several parameters may cause a partial reduction in prices of the so-called investment-oriented housing.”